Intuit Enterprise Suite Vs Quickbooks On-line: Whats The Difference?

2024-01-18What’s Sundry Income And The Way Does It Work In Business?

2024-04-23Mixed Cost Examples Across Industries

You can adjust pricing to account for fixed costs like rent and variable costs like packaging. These tools enable businesses to make informed decisions that enhance profitability, optimize resource https://matrix168.net/online-hr-services-payroll-benefits-and-everything-2/ allocation, and ensure financial stability. For more complex situations where the relationship between costs and activity levels is not linear, regression analysis can be used.

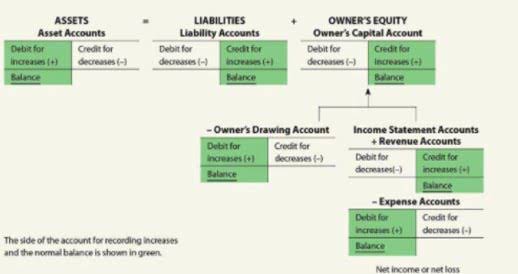

Variable, fixed and mixed (semi-variable) costs

Mixed costs, as the name suggests, include both fixed and variable costs. The fixed portion of a mixed cost is constant regardless of the level of production, while the variable portion changes with production levels. Examples of mixed costs include utility bills, telephone bills, and maintenance costs. The fixed portion of a mixed cost represents the minimum cost incurred, while the variable portion represents the additional cost incurred with an increase in production. But materials to make each product are your variable costs because these will vary based on how many items you’re making. Other than the example above, during the normal course of business, there are numerous examples of mixed costs that the company bears and pays.

The Role of Semi-Variable Costs in Business Operations

Understanding step costing is extremely important when a company is about to reach a new and higher activity level, where it will be required to traverse a large step cost. In some cases, the step cost may eliminate profits that management had been expecting with increased volume. Software is available to calculate the Suspense Account best fitting line, the resulting fixed cost and variable rate, and additional statistical insights such as the level of confidence for various amounts. The more fixed costs a company has, the more revenue a company needs to generate to be able to break even, which means it needs to work harder to produce and sell its products. That’s because these costs occur regularly and rarely change over time. However, if the company doesn’t produce any units, it won’t have any variable costs for producing the mugs.

- Fixed costs remain constant regardless of business activity, while variable costs fluctuate based on production or sales volume.

- This article explores the definition, characteristics, examples, and importance of semi-variable costs in business operations.

- It is important to prepare the scattergraph for all three of the above methods, since it allows you to see if some of the plotted points are simply out of line.

- Accurate reporting mechanisms enable management to evaluate cost trends, identify areas of improvement, and make well-informed decisions.

- Both these components are added together to arrive at the total mixed cost of the company.

- The point where the trendline touches the Y-axis represents the fixed component of the mixed cost.

How can F&B businesses effectively differentiate between fixed and variable costs within mixed expenses?

Effective cost control mechanisms help in aligning costs with revenues, ensuring sustainability and profitability in the long run. These examples highlight the dual nature of mixed costs, where part of the cost remains stable while the other part fluctuates with business activity. A company in such a case will need to evaluate why it cannot achieve economies of scale. In economies of scale, variable costs as a percentage of overall cost per unit decrease as the scale of production ramps up.

- During the normal operation cycle, there are several costs that businesses normally incur.

- Variable cost and average variable cost may not always be equal due to price increases or discounts.

- Rent for office space, salaries for permanent staff, and insurance premiums all fall under fixed costs.

- The total cost of the phone plan would be equal to the fixed component of $50.

The total amount can vary each month because it depends on how much you use or produce in addition to the constant part. You might have a base fee that covers furnace maintenance and basic usage. If it gets really cold and you need to heat your home more, the bill will increase because you are using more gas or electricity.

Identifying and calculating fixed costs in financial statements is straightforward, as these costs are usually listed as consistent, recurring expenses. To calculate total fixed costs, you can aggregate all the fixed expenses listed under operating expenses or overhead costs in the income statement. By the end of this article, you will have a thorough understanding of fixed, variable, and mixed costs, and how to apply this knowledge in both exam settings and real-world business situations.

- It may make sense to incur higher step costs if revenue is sufficient to cover the higher cost and provide an acceptable return.

- They can be easily calculated by adding the fixed and variable components together.

- The implementation of cost-reduction strategies involves continuous monitoring and planning to streamline expenses and enhance efficiency.

- With a detailed view of these costs, you can estimate how mixed costs will vary with different activity levels, which is a good way to construct a budget that accurately reflects company operations.

- One important point to note about variable costs is that they differ between industries, so it’s not at all useful to compare the variable costs of a car manufacturer and an appliance manufacturer.

Mixed Cost Examples Across Industries

Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. This is important for accurate financial reporting and compliance with… Kristin is a Certified Public Accountant with 15 years of experience working with small business owners in all aspects of business building. In 2006, she obtained her MS in Accounting and Taxation and was diagnosed with Hodgkin’s Lymphoma two months later. Instead mixed cost definition of focusing on the fear and anger, she started her accounting and consulting firm.